Buying your first home is an exciting and significant milestone in your life. However, it can also be a complex and daunting process, especially if you’re unfamiliar with the real estate market. To help you navigate this journey successfully, I’ve compiled a list of 10 essential tips for first-time homebuyers.

Establish a Budget:

Determine how much you can afford before you start house hunting. Consider your current financial situation, including income, expenses, and outstanding debts. Use online calculators to estimate your monthly mortgage payments, property taxes, and insurance costs. Setting a realistic budget will guide your search and help you avoid falling in love with homes out of your price range.

Save for a Down Payment:

In most cases, you’ll need a down payment to secure your home loan. While the typical down payment is around 20% of the home’s purchase price, some programs allow for lower down payments. Start saving early to ensure you have enough money when it’s time to make an offer.

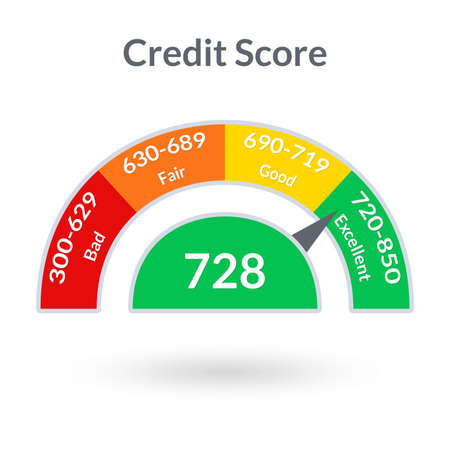

Check Your Credit Score:

A good credit score is essential for getting favorable mortgage rates. Check your credit report for errors and work on improving your credit score if necessary. Paying off debts, paying bills on time, and keeping credit card balances low can help boost your creditworthiness.

Check out https://www.experian.com/blogs/ask-experian/what-credit-score-do-i-need-to-buy-a-house/ to see what your credit score needs to be to purchase a home.

Get Pre-Approved for a Mortgage:

Before you begin house hunting, obtain pre-approval from a reputable lender for a mortgage. This step gives you a better idea of how much you can borrow and makes you a more attractive buyer to sellers. Sellers typically will require a pre-approval from a local lender.

Research Neighborhoods:

Consider the location of your prospective home carefully. Research the neighborhoods you’re interested in and evaluate factors such as school quality, safety, proximity to work, and amenities. Visit neighborhoods at different times of the day to get a feel for the area.

Hire a Real Estate Agent:

Working with a qualified real estate agent can simplify the home-buying process. They can help you find suitable properties, negotiate on your behalf, and provide valuable insights about the local market.

Need a real estate agent to help you in your search? See how I can help: https://chelsearowerealtor.com/about/

Be Patient and Diligent:

Don’t rush into a decision. Take your time to view multiple properties, ask questions, and thoroughly inspect homes you’re interested in. Reviewing the property’s history, including past sales and any potential issues is crucial.

Consider Future Expenses:

Factor in the purchase price and the ongoing costs of homeownership. This includes property taxes, insurance, maintenance, and potential renovations. Ensure that your budget can comfortably accommodate these expenses.

Get a Home Inspection:

A professional home inspection is a must to uncover any hidden issues with the property. Don’t skip this step, as it can save you from costly surprises down the road. This can be a major mistake made by first-time home buyers. If problems are discovered, you may have room to negotiate repairs or concessions from the seller at closing.

Check out my blog on the types of inspections during the home buying process: https://chelsearowerealtor.com/3-inspections-during-the-home-buying-process/

Don’t Rush the Decision:

Buying a home is a significant commitment, and being confident in your decision is essential. As first-time home buyers, it is important to take your time to evaluate all options. Consult with professionals, such as financial advisors and your real estate agent, before making an offer. Trust your instincts and ensure your chosen home aligns with your long-term goals.

In conclusion, buying your first home is a big step. Still, with careful planning and consideration, it can be a rewarding experience. By following these essential tips, you can make informed decisions throughout the process and increase your chances of finding the perfect home that suits your needs and budget. Remember that the journey to homeownership is a marathon, not a sprint, so take it one step at a time, and soon, you’ll be unlocking the door to your dream home.

Recent Comments